All Categories

Featured

Table of Contents

If you take a distribution versus your account prior to the age of 59, you'll likewise have to pay a 10% fine. The IRS has enforced the MEC regulation as a method to prevent individuals from skirting tax obligation obligations. Boundless financial only functions if the cash money worth of your life insurance policy policy remains tax-deferred, so ensure you don't turn your policy into an MEC.

As soon as a cash money value insurance coverage account classifies as an MEC, there's no way to reverse it back to tax-deferred status. Unlimited banking is a practical idea that uses a selection of benefits.

You can profit of limitless banking with a variable universal life insurance policy or an indexed universal life insurance plan. Since these types of policies tie to the supply market, these are not non-correlated assets. For your policy's cash worth to be a non-correlated asset, you will require either entire life insurance policy or global life insurance.

Before picking a plan, discover if your life insurance policy firm is a common firm or otherwise, as just shared companies pay returns. The following time you need a large sum of cash to make a down payment on a home, spend for college tuition for your children, or fund a brand-new financial investment You will not need to dip into your interest-bearing account or look for loan providers with low-interest prices.

How does Financial Leverage With Infinite Banking create financial independence?

By taking a funding from you rather than a typical lending institution, the debtor can save countless bucks in interest over the life of the lending. (Just be certain to bill them the same interest rate that you have to pay back to on your own. Otherwise, you'll take a monetary hit).

Since of the MEC regulation, you can not overfund your insurance plan also much or as well quickly. It can take years, if not decades, to construct a high money value in your life insurance coverage plan.

A life insurance coverage policy ties to your wellness and life expectancy. Depending on your medical background and pre-existing problems, you might not certify for an irreversible life insurance plan at all. With limitless banking, you can become your very own banker, obtain from on your own, and include cash worth to a permanent life insurance plan that grows tax-free.

When you initially listen to about the Infinite Financial Idea (IBC), your first response may be: This seems too great to be real - Life insurance loans. The trouble with the Infinite Banking Concept is not the principle however those individuals using an adverse review of Infinite Banking as a concept.

So as IBC Authorized Practitioners via the Nelson Nash Institute, we assumed we would certainly respond to a few of the leading questions individuals look for online when finding out and recognizing whatever to do with the Infinite Financial Concept. What is Infinite Banking? Infinite Banking was created by Nelson Nash in 2000 and totally explained with the publication of his publication Becoming Your Own Lender: Unlock the Infinite Financial Idea.

How do interest rates affect Self-banking System?

You assume you are coming out monetarily ahead due to the fact that you pay no interest, but you are not. With saving and paying money, you might not pay passion, however you are using your money as soon as; when you spend it, it's gone for life, and you give up on the opportunity to gain lifetime substance rate of interest on that cash.

Billionaires such as Walt Disney, the Rockefeller family members and Jim Pattison have leveraged the residential properties of whole life insurance coverage that dates back 174 years. Also banks use whole life insurance coverage for the very same objectives.

Can I use Infinite Banking Vs Traditional Banking for my business finances?

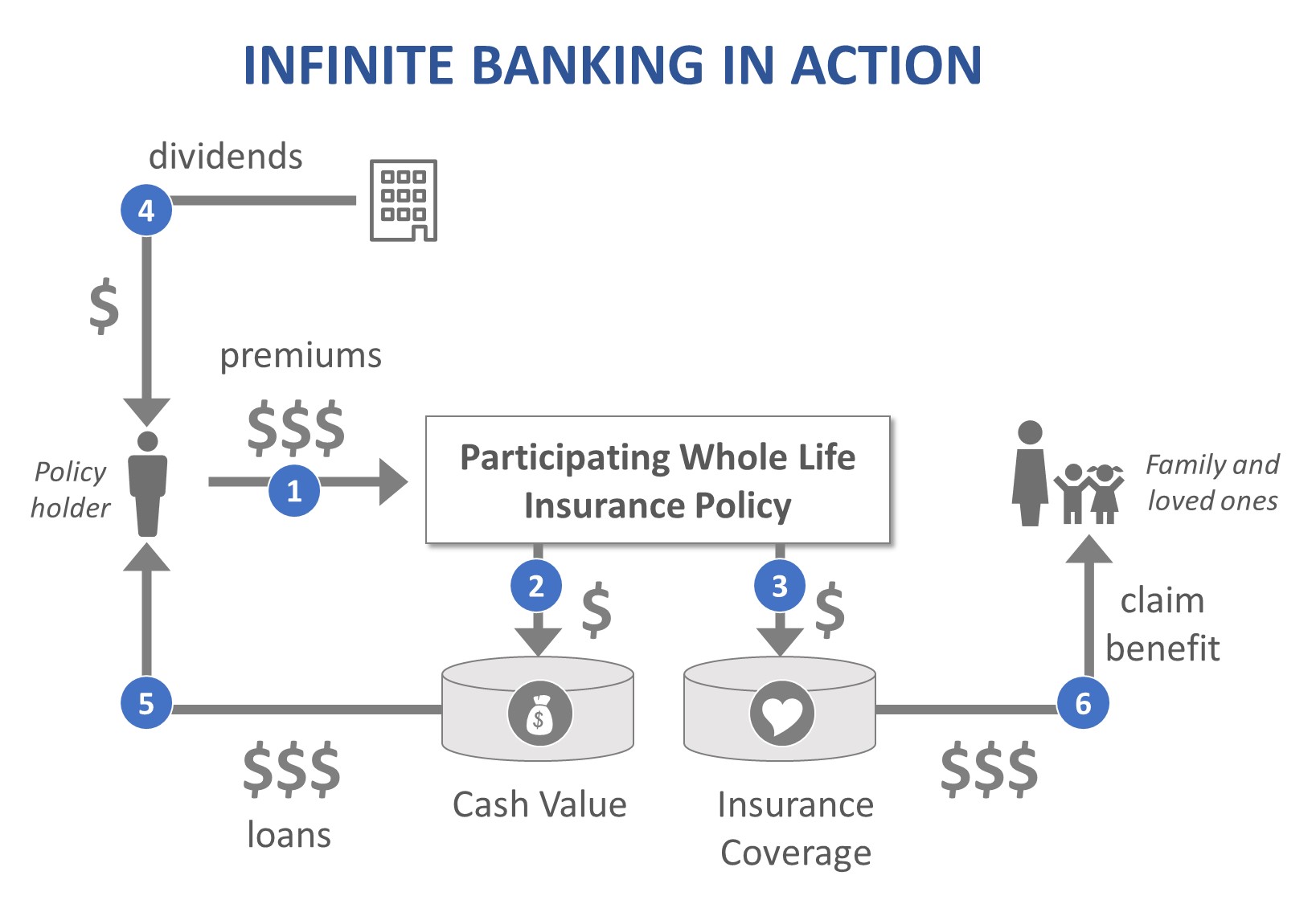

It permits you to create riches by satisfying the financial function in your very own life and the capability to self-finance significant way of life acquisitions and expenditures without interrupting the substance interest. One of the easiest means to think about an IBC-type participating entire life insurance policy policy is it approaches paying a home loan on a home.

Over time, this would develop a "continuous compounding" result. You get the picture! When you obtain from your getting involved entire life insurance policy plan, the money worth proceeds to grow uninterrupted as if you never obtained from it to begin with. This is because you are utilizing the cash money value and survivor benefit as security for a financing from the life insurance firm or as security from a third-party loan provider (recognized as collateral loaning).

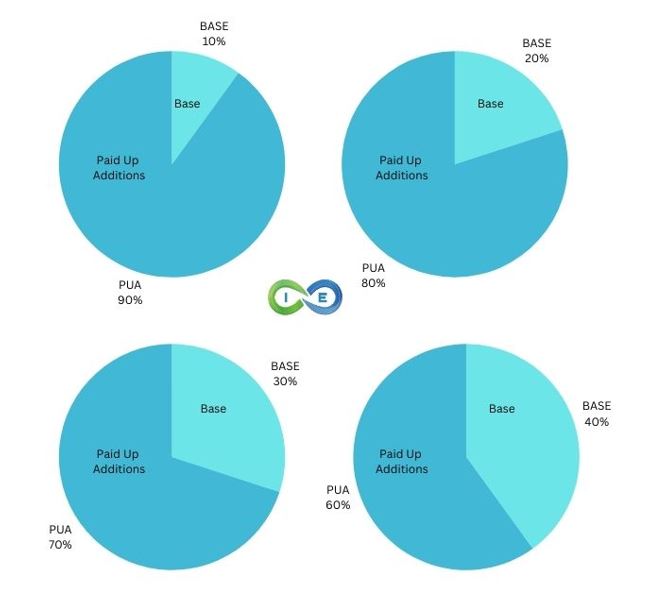

That's why it's important to deal with a Licensed Life insurance policy Broker accredited in Infinite Banking who structures your getting involved whole life insurance coverage policy appropriately so you can stay clear of unfavorable tax implications. Infinite Financial as an economic strategy is except everybody. Here are several of the benefits and drawbacks of Infinite Banking you should seriously think about in deciding whether to move on.

Our preferred insurance policy carrier, Equitable Life of Canada, a common life insurance policy firm, concentrates on getting involved entire life insurance policy plans details to Infinite Financial. In a common life insurance coverage business, policyholders are considered firm co-owners and obtain a share of the divisible excess produced each year through returns. We have a variety of providers to select from, such as Canada Life, Manulife and Sunlight Lifedepending on the requirements of our clients.

How do interest rates affect Whole Life For Infinite Banking?

Please additionally download our 5 Top Concerns to Ask A Limitless Financial Representative Before You Employ Them. For additional information concerning Infinite Banking browse through: Please note: The product provided in this e-newsletter is for informational and/or instructional functions only. The info, viewpoints and/or sights shared in this newsletter are those of the authors and not necessarily those of the supplier.

Latest Posts

Benefits Of Infinite Banking

Can anyone benefit from Infinite Banking Cash Flow?

How do I leverage Wealth Management With Infinite Banking to grow my wealth?