All Categories

Featured

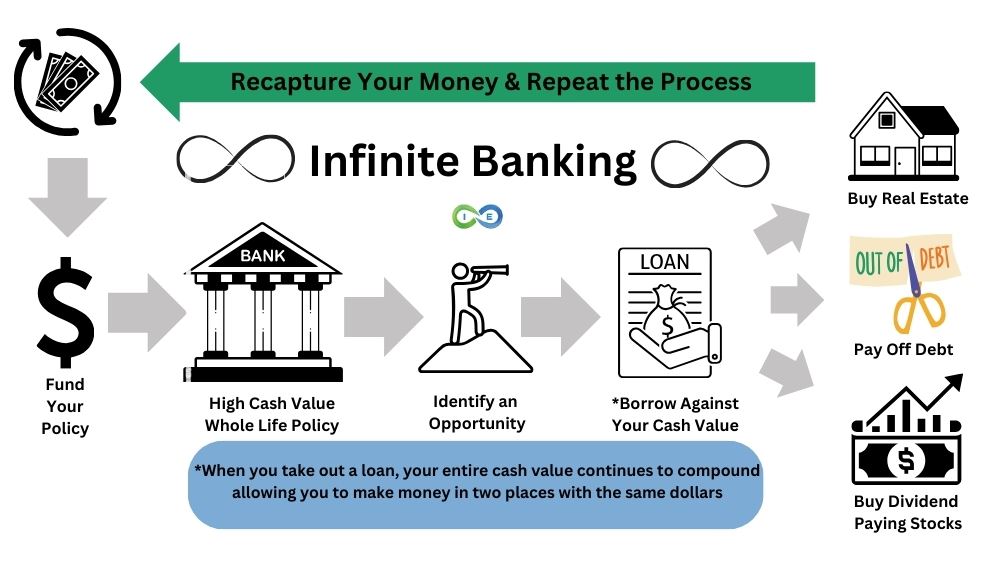

Entire life insurance coverage policies are non-correlated properties - Infinite Banking wealth strategy. This is why they work so well as the economic foundation of Infinite Financial. No matter what takes place in the marketplace (supply, property, or otherwise), your insurance plan retains its worth. A lot of individuals are missing out on this essential volatility barrier that aids safeguard and grow riches, instead dividing their money right into two containers: checking account and investments.

Market-based financial investments expand wide range much faster yet are exposed to market variations, making them inherently high-risk. Whole life insurance policy is that third container. Infinite wealth strategy. Privatized banking system.

To successfully implement Infinite Banking, it’s essential to consult an experienced broker (best insurance companies for infinite banking).

A well-designed policy allows for flexible borrowing that enhance long-term financial security.

Unlike traditional loans, Infinite Banking ensures that borrowed funds continue earning interest. Speak with an Infinite Banking consultant today to secure a whole life policy tailored to your needs.

Latest Posts

Bank On Yourself Insurance Companies

Becoming Your Own Banker Nelson Nash Pdf

Be Your Own Banker Whole Life Insurance